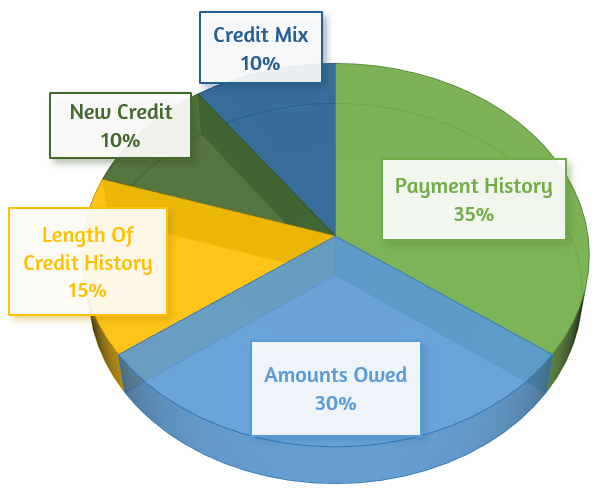

Ever wonder what exactly goes into your credit score? The five categories below will outline it all for you.

Your Payment History: determines approximately 35% of your current credit score. The credit scoring model is looking to see if you have paid your bills on time in the past and if you are currently behind on any of your bills. Specifically, the score will calculate the total number of accounts paid on time and the number of accounts past due. Past due accounts will be rated by the amount past due, length of time past due, and how recently it was past due.

How Much You Owe: Your outstanding debt determines approximately 30% of your credit score. The scoring model will evaluate three categories:

•The total amount you owe to all of your creditors.

•How many accounts you have with balances – too many accounts could indicate a higher credit risk of default if the client can’t handle the payments.

•How much of the credit limit you are using on revolving accounts, under 30% -35% of the available credit limit is ideal.

•Balances on installment loans – low balances reflect a positive payment history.

Your Length of Credit History: Approximately 15% of your credit score is calculated by the length of your credit history. This category looks at how long your accounts have been opened and the length of time since the last activity on the account. A long credit history will maximize your credit score although a short credit history with responsible use of credit is fine.

Inquiries or New Credit: Approximately 10% of your credit score, this category will weigh the amount of inquiries for new credit over the period of time that they occurred. In other words, the scoring model will determine if you were rate shopping for a specific loan over a short period of time or if you are opening several new trade lines, and possibly overextending yourself.

Your Mix of Credit: 10% of your credit score is derived from the type of credit you have managed on your credit report. The ideal model is to have a mortgage, a car loan, credit cards, reflecting positive payment histories. The credit score is looking to see that you have obtained and used credit different types of credit responsibly.

Ref: Financial Education Services (FES)